The savvy investor’s guide in property investments post 2013’s cooling measures

By Khalil Adis

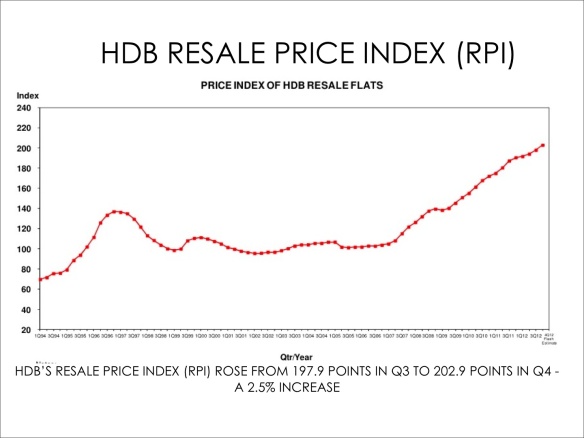

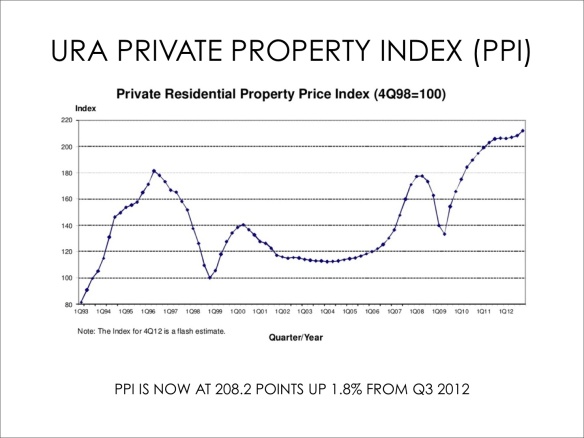

Both Singapore’s private and public property markets are now experiencing record highs in property prices.

Last Sunday, I had the privilege to be invited to give a property talk at Naung Residence just right after the property cooling measures kicked in on 12 January 2013.

The cooling measures had hit the market hard, much like a tsunami with a multi-pronged approach to ensure a more sustainable property market.

In fact, this time round, the property curbs will have more “bite” to ensure property prices rise in tandem with income.

Property prices in Singapore, both HDB resale and private, have hit their record highs causing the government to announce another round of cooling measures.

According to flash estimates from the HDB and Urban Redevelopment Authority (URA), the HDB Resale Price Index (RPI) and Private Property Index (PPI) are now at 202.9 points and 211.9 point respectively (see figures 1 and 2).

Figure 1. Source: HDB. Taken from Khalil Adis’ property talk: ‘Understanding the mind of savvy property investors and the contrarian concept’.

Figure 2. Source: URA. Taken from Khalil Adis’ property talk: ‘Understanding the mind of savvy property investors and the contrarian concept’.

In fact, the PPI grew three times from an increase of 0.6 per cent in the third quarter to 1.8 per cent in the fourth quarter of 2012.

Driving demand is the low interest rate environment, a genuine need for homes and money that needs to be invested somewhere.

Thus, the cooling measure is aimed at ensuring first time homeowners are not unfairly disadvantaged by the record high prices.

How the new cooling measures affect you

Many readers and investors have asked me if they will be penalised by the new ruling.

My answer is yes and no.

If you are first time Singaporean homeowner buying a private property, you will not be affected as you are seen as a genuine buyer who needs a roof over your head.

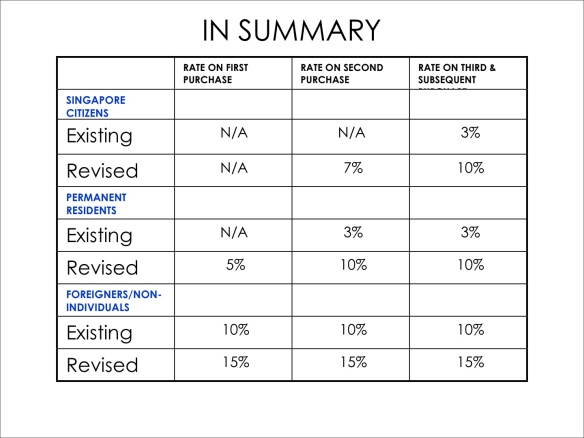

However, first time permanent residents (PRs) will be slapped with a 5 per cent on the new rate of the Additional Buyers’ Stamp Duty (ABSD).

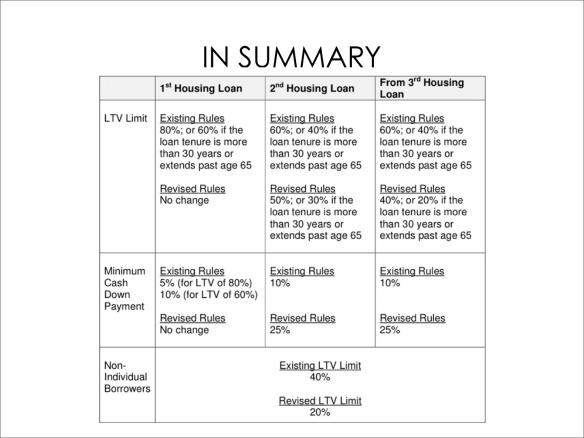

There are also new loan-to-value (LTV) limits and minimum cash down payments imposed.

For a summary of the cooling measure, refer to the diagram below:

Figure 3. Source: URA. Taken from Khalil Adis’ property talk: ‘Understanding the mind of savvy property investors and the contrarian concept’.

Figure 4. Source: URA. Taken from Khalil Adis’ property talk: ‘Understanding the mind of savvy property investors and the contrarian concept’.

Which areas to look out for?

To ease pressure on the price increases, the government has been releasing more land under the Government Land Sales (GLS) programme.

In fact, those under the confirmed list for the first half of 2013 will yield about 14,000 private residential units, including 3,100 executive condos.

Most land sales under the confirmed list will be located in the suburbs.

Therefore, mass-market projects, particularly, those located close to MRT stations will be popular.

Private or resale HDB flats?

Last year, an executive HDB resale flat in Queenstown hit a record price of S$1 million with a cash-over-valuation (COV) of S$195,000.

In an interview that I did with PropertyGuru, I mentioned how million dollar HDB flats will be the norm.

This is because of an anomaly in the market whereby there are private property owners looking to downgrade to an HDB flat and are willing to pay a premium for HDB flats in good locations such as Tanjong Pagar, Bishan and Queenstown, near MRT stations and command unblocked view.

With the record highs achieved in HDB resale flats, their prices are no longer sustainable and can no longer command good rental yield.

A good rental yield is defined as low purchase price versus high rental income.

Typically, such properties can be found in Geylang and Balestier with a rental yield of around 4 to 5 per cent.

Thus, the only way forward to achieve a better return on your investment is to buy a private property direct from a developer, in the suburbs that is near to MRT stations.

Comparing Isuites @ Tani to Naung Residence

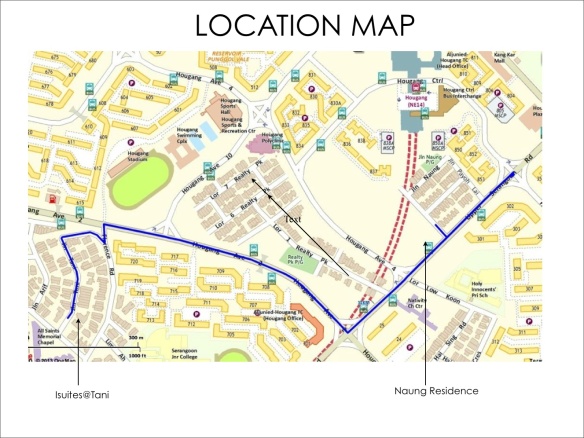

Figure 5. Source: One Map. Taken from Khalil Adis’ property talk: ‘Understanding the mind of savvy property investors and the contrarian concept’.

For the purpose of my research, I have chosen a similar property located in Hougang to compare it to Naung Residence, since the latter is still under construction.

Both properties are 999-years leasehold.

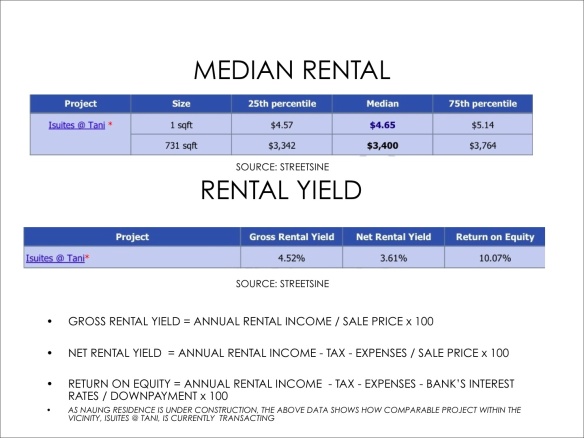

According to data from Streetsine, Isuites @ Tani enjoys a gross rental yield of 4.52 per cent, a net rental yield of 3.61 per cent and a return on equity of 10.07 per cent (see diagram below how figures are derived).

Figure 6. Source: Streetsine. Taken from Khalil Adis’ property talk: ‘Understanding the mind of savvy property investors and the contrarian concept’.

Now, if Isuite @ Tani, which is located away from Hougang MRT station can enjoy such return on investment, what more for Naung Residence which is located within five minutes walk to the station?

Remember, the property market is governed by demand and supply.

Close proximity to MRT stations and amenities will mean more demand from tenants who do not mind paying a premium for such location.

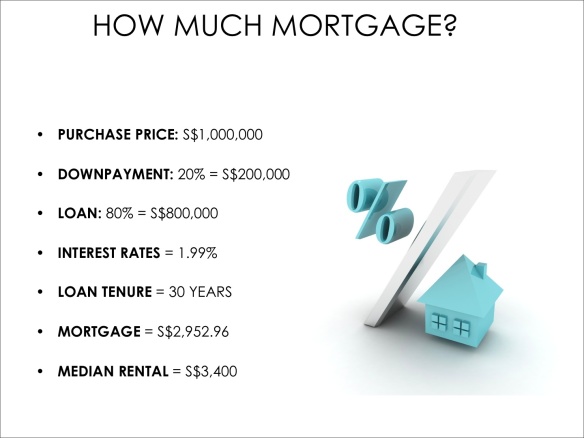

Calculating mortgages

Data from Streetsine also showed that Isuite @ Tani enjoys a median rent of S$3,400.

Assuming you bought a property at Naung Residence for S$1 million, the mortgage works out to S$2,952.96 (see the following diagram).

Figure 7. Taken from Khalil Adis’ property talk: ‘Understanding the mind of savvy property investors and the contrarian concept’.

A year for the singles

I mentioned before in my previous blog post how singles should wait out until the government announces new announcement.

Well, on 14 January 2013, the Ministry for National Development (MND) finally announced singles can buy direct from the HDB.

I would urge singles to take advantage of this scheme as buying a BTO flat is much cheaper than buying a resale flat.

In addition, you will be entitled to a CPF Grant, enabling you to use it for the down payment in the purchase of your flat.

Every Singaporean must enjoy this at least once!

In the meantime, I would urge you to wait for more announcements for this new scheme and then apply direct with the HDB.

Prime areas to watch out for

While I have said in my property talks that affordability will drive the property market, that does not mean you have to avoid prime areas altogether.

If you have the cash, then I would urge you to buy projects in District 10 which is now very attractive post the January 2013 cooling measures.

Currently, CapitaLand is offering 10 per cent discount for one and two-bedrooms, 12 per cent four-bedrooms and 15 per cent for three-bedrooms at d’leedon.

Just a little bit of background – in 2008, I had the privilege to interview Zaha Hadid when it was announced she has been roped in to design the former Farrer Court site that is being developed by CapitaLand.

Hadid is a Pritzker Prize Winner who is known for her bold, futuristic and cutting edge architectural designs like the BMW Central Building in Leipzig, Germany and London Aquatics Centre in the United Kingdom.

“This project presented an opportunity to continue exploring the architectural language of fluidity. For d’Leedon, our first residential project in Singapore, we have been inspired by the site’s unique spatial qualities, allowing us to introduce new design concepts,” said Hadid.

Limited edition property

d’leedon marks a major milestone for Singapore in many ways.

Firstly, it marks Hadid’s first condominium project in Singapore.

Secondly, it features Hadid’s signature style that adds an iconic touch to Singapore’s exciting skyline.

I also interviewed analysts back then who said designer developments such as d’leedon are like limited art collection.

It is an investment which may help to increase the return on your investments due to demand and supply mechanics.

Obviously, other factors like location, views and so on are important considerations.

If that still does not convince you, perhaps the many good schools surrounding the project will.

Parents, take note: d’leedon is surrounded by Nanyang Primary School, Raffles Girls’ Primary School and Hwa Chong Institution.

Now, you can’t go wrong with such an investment.